Middle East Lubricants Market: Expansion, Innovation, and Future Growth

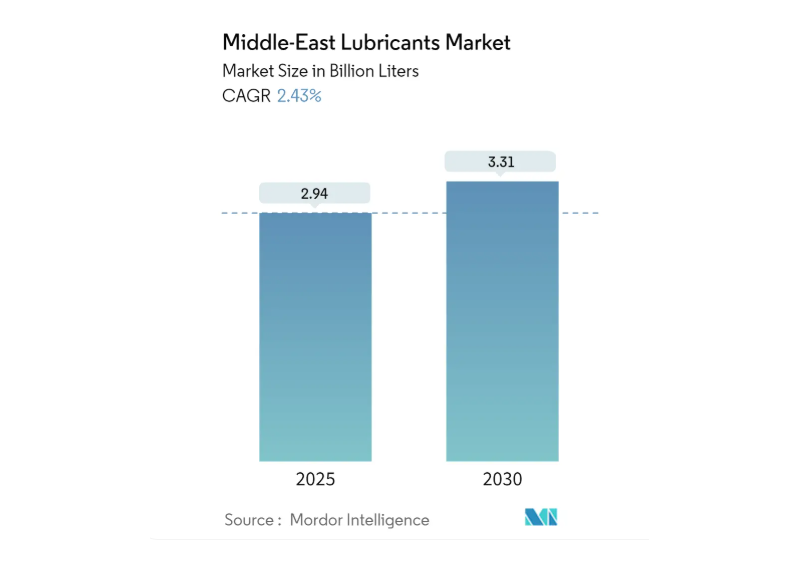

In 2025, the Middle East Lubricants Market is projected to reach 2.94 billion liters, growing to 3.31 billion liters by 2030 at a CAGR of 2.43%. Saudi Arabia remains the largest market, propelled by infrastructure investments, an expanding automotive industry, and industrial localization efforts under Vision 2030. Meanwhile, the emergence of bio-based and synthetic lubricants is reshaping industry trends, presenting both opportunities and challenges.

Industrial and Automotive Growth Driving Market Expansion

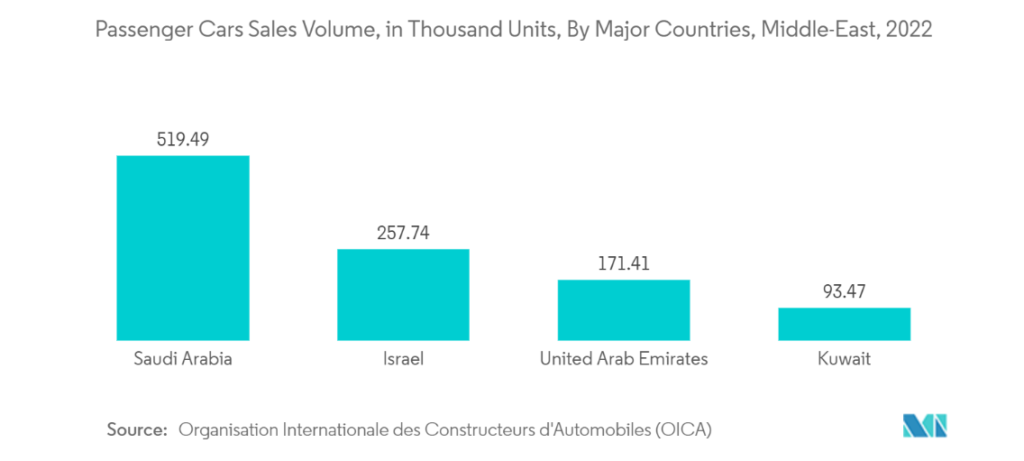

Lubricants play a critical role in maintaining machinery efficiency and reducing wear and tear in industrial applications. The automotive sector—one of the largest consumers of lubricants—is expected to see stable growth across Saudi Arabia, Iran, and the UAE. Increasing vehicle registrations, coupled with demand for high-mileage engine oils, will contribute to lubricant sales.

Saudi Arabia’s automotive landscape is dominated by ICE (internal combustion engine) vehicles, with top brands like Toyota (30%), Hyundai/KIA (26%), and Renault-Nissan-Mitsubishi (9%) controlling the market. While global electric vehicle adoption is accelerating, the Middle East is expected to remain reliant on traditional fuels for the next 15-20 years, ensuring continued demand for engine and transmission lubricants.

In Iran, automobile manufacturing grew 19% in 2022, reaching 1.064 million vehicles, reinforcing the demand for high-quality lubricants. This growth ranked Iran sixth worldwide in production growth, highlighting the importance of lubricants in the country’s evolving automotive industry.

The power generation sector also plays a crucial role in driving lubricant consumption. Saudi Arabia plans to spend USD 293 billion on energy projects by 2030, including a USD 38 billion investment in energy distribution. Power plants require specialized lubricants for turbines, generators, and grid infrastructure, supporting long-term market stability.

Challenges: Costs and Market Concentration

While high-performance synthetic and bio-based lubricants offer improved efficiency and environmental benefits, their costs remain a significant barrier. Many industries continue to favor conventional mineral-based lubricants due to affordability, slowing the widespread adoption of advanced formulations.

The Middle East Lubricants Market is moderately concentrated, with key players including TotalEnergies, Petromin, Aljomaih and Shell Lubricating Oil Company (JOSLOC), Behran Oil Co., and FUCHS. While competition exists, market leaders are focusing on sustainability and innovation to strengthen their positions.

Saudi Arabia’s Lubricant Demand: A Key Growth Driver

Saudi Arabia is not only the region’s largest economy but also the fastest-growing lubricants market. As the country expands its steel production (9.9 million metric tons in 2023) and invests USD 12 billion in new projects, the demand for industrial lubricants is expected to surge. Additionally, companies like Nestlé are setting up manufacturing plants, increasing the need for food-grade lubricants.

The country’s National Renewable Energy Program aims to boost renewable energy production to 9.5 GW by 2023, necessitating lubricant solutions that optimize turbine and generator performance.

Also Read: Why Middle East Lubricants Are Key to Saudi GDP Growth

Future Outlook: Growth Amidst Changing Industry Dynamics

With industrial expansion and automotive sector stability, the Middle East Lubricants Market is expected to maintain steady growth. However, evolving regulations, sustainability concerns, and pricing pressures will shape market strategies. Manufacturers must balance affordability and innovation to cater to the region’s diverse industrial needs.