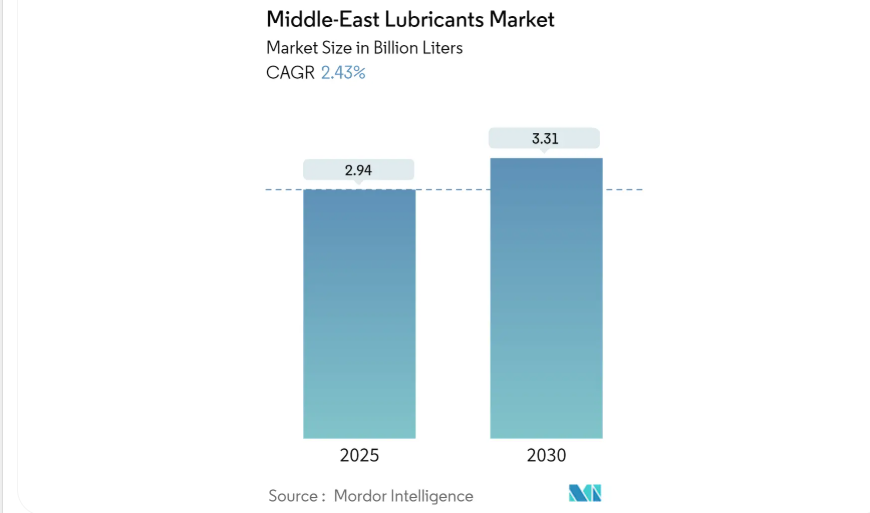

Middle East Lubricants Market to Reach 3.31 Billion Liters by 2030

The Middle East Lubricants Market is projected to grow steadily at a CAGR of 2.43%, expanding from 2.94 billion liters in 2025 to 3.31 billion liters by 2030. With post-pandemic industrial recovery underway, regional players are turning the gears of growth through increased automotive activity, infrastructure investment, and technological innovation.

Industrial Surge in Saudi Arabia Accelerates Lubricant Demand

Saudi Arabia’s investment in infrastructure and heavy industry is a catalyst for lubricant consumption—especially in power generation and steel manufacturing. Key indicators include:

- USD 293 billion earmarked for the power and renewable energy sector by 2030

- Annual investment goal of 160 GW capacity by 2040

- USD 12 billion allocated to steel expansion, targeting 6.2 million tons output

- Crude steel production rose 0.8% in 2023, totaling 9.9 million metric tons

- Nestlé’s SAR 375 million manufacturing plant opening in 2025 signals rising demand from food and beverage industries

These initiatives call for high-performance lubricants to protect turbines, gearboxes, and machinery under extreme conditions.

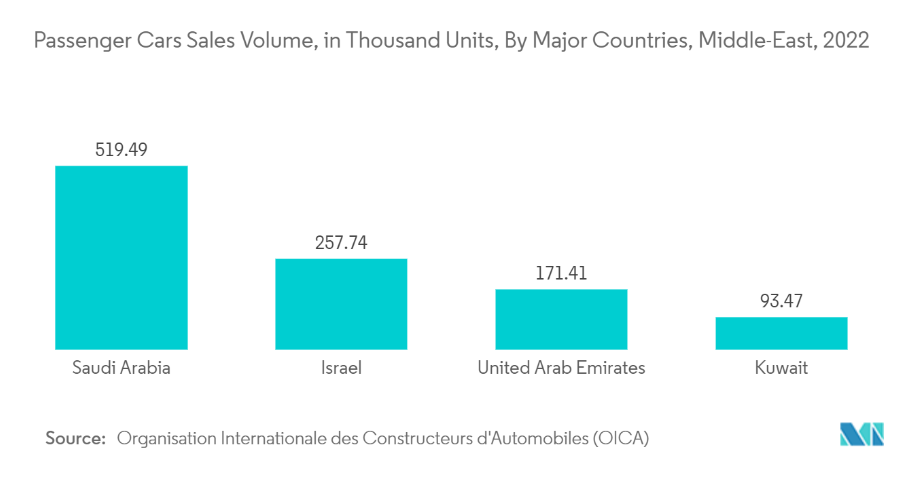

Automotive Lubricants Dominate Across GCC

The transport segment remains the cornerstone of the Middle East Lubricants Market, led by Saudi Arabia, where internal combustion engine vehicles account for the lion’s share. Despite the global EV trend, 10W40 and 15W40 engine oils maintain strong demand due to their wear-reducing and oil retention features.

Iran posted a 19% rise in vehicle production in 2022, while the UAE saw a 20.2% spike in registrations between January and September 2023. As average vehicle age climbs, aftermarket lubricant sales are likely to accelerate.

Synthetic & Bio-Based Lubricants Spark Fresh Opportunities

Technological advancements in synthetic and bio-based lubricants are opening up new market niches. These eco-conscious options offer superior thermal stability and reduced environmental impact, crucial for industries such as food processing and chemicals, where regulatory standards and performance go hand in hand.

Saudi Arabia Leads; Iran and UAE Gain Ground

Saudi Arabia not only tops the volume charts but is also poised to register the highest growth rate in the forecast period. Iran’s robust automotive production and the UAE’s consistent consumer demand underscore the region-wide momentum. Emerging markets like Kuwait and Iraq are expected to follow suit, adding to the diversity of this fragmented industry.

Competitive Landscape Still Wide Open

The Middle East Lubricants Market remains fragmented, with competition driven by product launches and partnerships. Key players include TotalEnergies, Petromin, FUCHS, Behran Oil Co., and Aljomaih & Shell (JOSLOC). Innovation—like the release of Rotella HD 25W50 for diesel engines—is shaping brand strategies as companies vie for dominance in both B2B and retail segments.

Also Read: Saudi’s Lubricants Lead with Fastest CAGR to 2030