Gulf Countries and the Role of Metal Trading in Economic Diversification and the Global Energy Transition

As the global economy pivots towards sustainability, Gulf countries are rising to meet the call for diversification and innovation. With their strategic location and resource-rich environment, these nations have recognized the need to expand beyond oil-dependent economies. One emerging trend is the development of metal trading companies, a step that not only aligns with global energy transition demands but also strengthens economic resilience. As the Middle East Lubricants sector adapts to this broader vision, the synergy between metal trading and industrial sustainability becomes increasingly evident.

The Need for Economic Diversification

For decades, Gulf countries have relied on hydrocarbon revenues, which, although lucrative, leave economies vulnerable to oil price volatility. Visionary initiatives, such as Saudi Arabia’s Vision 2030, emphasize diversification as a cornerstone of long-term growth. These strategies have catalyzed investment into sectors like renewable energy, technology, and crucially, metal trading. By 2020, the GCC steel market alone was valued at approximately US $15.23 billion, with projections to grow at a CAGR of 6.2% during the forecast period of 2021-2026.

Global Energy Transition as a Catalyst

The energy transition is a worldwide shift towards sustainable solutions, such as renewable energy and electric vehicles (EVs). These developments rely heavily on metals like lithium, cobalt, and copper, which are vital for EV batteries, solar panels, and wind turbines. By establishing robust metal trading infrastructure, Gulf nations are not only responding to global needs but also enhancing their supply chains. Additionally, these ventures strengthen integration with the Middle East Lubricants industry, where advancements in manufacturing require sustainable raw materials.

Strategic Investments and Collaborations

Gulf countries have invested billions in developing infrastructure for mining, refining, and trading metals. Governments have entered into partnerships with international firms to ensure access to global markets while leveraging local expertise. The Dubai Multi Commodities Centre (DMCC), for instance, plays a pivotal role in transforming the UAE into a global trading hub. The Dubai Multi Commodities Centre (DMCC), established in 2002, is a leading global hub for commodities trade and enterprise. It fosters industries such as precious metals, diamonds, energy, agriculture, and technology. The DMCC has facilitated over 25,000 companies, contributing significantly to the UAE’s GDP. In Saudi Arabia, the mining sector is expected to attract $32 billion in investments by 2030, further solidifying its role as a global trading hub.

Economic and Environmental Impact

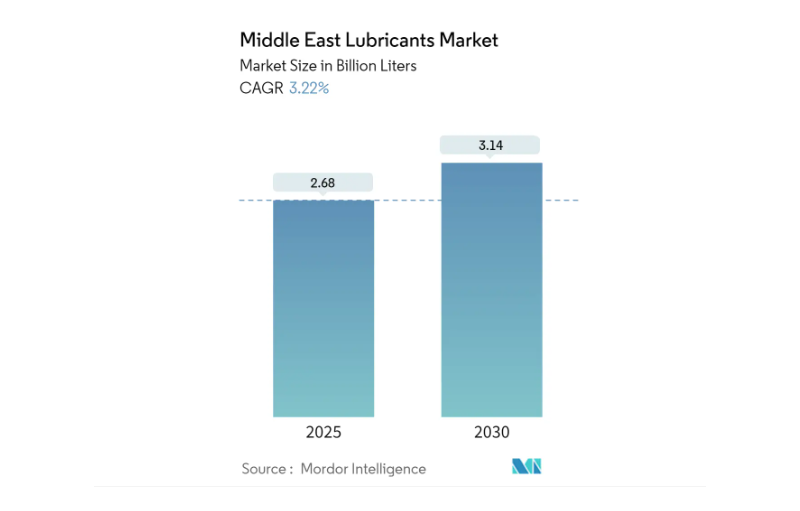

The push for metal trading aligns economic interests with environmental goals. Beyond generating revenue, this sector enables Gulf countries to contribute to sustainable practices globally. Efficient metal recycling initiatives, modern refining techniques, and green energy integration in mining are all efforts that minimize the environmental footprint. Moreover, this complements the efforts of Middle East Lubricants manufacturers, with the market projected to grow from 2.68 billion liters in 2025 to 3.14 billion liters by 2030, at a CAGR of 3.22%.

Conclusion: Towards a Sustainable Future

The development of metal trading companies underscores Gulf countries’ commitment to redefining their economic identity. By aligning their strategies with global energy transition demands, they are paving the way for an era of growth that harmonizes sustainability and innovation. The intersection of industries like metal trading and Middle East Lubricants symbolizes the region’s adaptability and forward-looking vision. As these nations build a stronger, more diverse economic framework, they position themselves as leaders not only in the Gulf but on the global stage.

Also Read: Sustainability in Focus: How the Middle East Lubricants Market is Adopting Green Practices