Saudi Arabia Leads Middle East in Lubricants Expansion

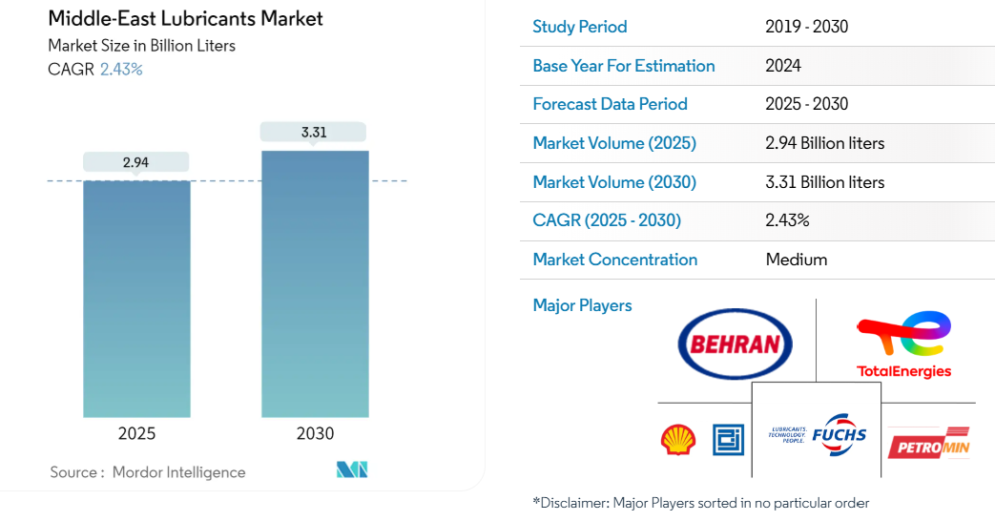

While the Middle East lubricants market is projected to grow from 2.94 billion liters in 2025 to 3.31 billion liters by 2030, Saudi Arabia stands out as the region’s largest national market with the highest CAGR forecast during this period. The country’s dominance is driven by robust automotive sales, a rebound in construction, and its fast-growing industrial base—positioning it as the leading force in overall Middle East Lubricants Growth, despite distinct national circumstances.

This upward trajectory follows a post-COVID recovery that began in 2021, when stalled infrastructure and manufacturing activity regained momentum across the kingdom.

Auto Sector’s Resilience Strengthens Lubricant Demand

Saudi Arabia’s transportation sector remains the largest consumer of lubricants, with consistent demand for high-performance engine oils. Grades like 10W40 and 15W40 are prevalent in diesel and gasoline engines, while 15W50 and 20W50 serve aviation applications.

A key driver behind sustained lubricant consumption is the increasing average age of vehicles, which creates recurring demand in the aftermarket refill market. As urban populations expand and personal mobility rises, these dynamics amplify Saudi Arabia’s contribution to Middle East Lubricants Growth, particularly in the private transport and logistics sectors.

Industrial Growth Accelerated by Vision 2030 Investment

Under its ambitious Vision 2030 framework, Saudi Arabia has prioritized economic diversification and non-oil sector development—resulting in non-oil GDP growth forecasts of 3.4% in 2025 and up to 4% by 2027. This transition bolsters demand for lubricants across construction, retail logistics, and domestic manufacturing.

In Q1 2025, non-oil activity expanded 4.9% year-on-year, reflecting strong private consumption and investment. Lubricants play a critical role in maintaining the performance and efficiency of machinery and transport assets across these sectors, embedding them in Saudi Arabia’s modernization efforts.

Synthetic and Bio-Based Oils Show Niche Potential

There is growing interest in synthetic and bio-based lubricants, especially for applications requiring longer drain intervals, enhanced heat resistance, and greater efficiency. These lubricants are gaining traction in sectors prioritizing performance over cost—such as aviation, precision engineering, and renewable energy operations.

However, adoption is tempered by cost sensitivity, which still affects purchasing decisions in several industrial segments. The rise of these advanced lubricants contributes to broader Middle East Lubricants Growth, but in Saudi Arabia, their uptake remains selective and driven by operational priorities.

Economic Policy and Inflation Trends Offer Stability

Despite challenges in oil production—Saudi Arabia’s Oil GDP contracted by 4.4% in 2024 due to extended OPEC+ output cuts—the kingdom maintained economic stability through targeted fiscal policies and resilient domestic consumption.

Inflation levels fell to 2.3% as of April 2025, aided by high interest rates and declining transport costs. Meanwhile, rent inflation eased to 8.1% year-on-year, the lowest since February 2023, creating a favorable environment for industrial expansion. Unemployment dropped to 7%, surpassing Vision 2030 targets, while private sector employment rose by 12%.

These fundamentals reinforce lubricant demand across sectors—even amid energy price volatility—further establishing Saudi Arabia as the growth engine within Middle East Lubricants Growth projections.

Also Read: Shifting Gears: Middle East Lubricants Market Rises with Auto Demand