Middle East Lubricants Market: A Resilient Industry Powering Regional Growth

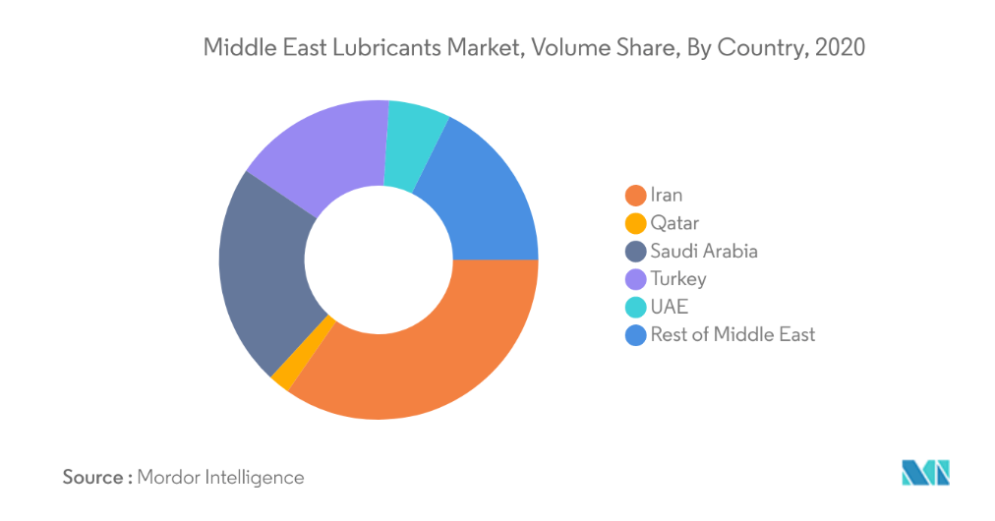

Lubricants are the lifeblood of industrial operations. From automotive engines to power plants, they ensure seamless machinery function while minimizing wear and corrosion. In the Middle East Lubricants Market, demand remains robust, with a projected increase from 2.94 billion liters in 2025 to 3.31 billion liters by 2030, marking a 2.43% CAGR. This steady trajectory reflects the resilience of key industries across the region, particularly in Saudi Arabia, Iran, and the UAE.

A Post-Pandemic Recovery Reshaping Market Demand

Few industries escaped the ripple effects of the COVID-19 pandemic. Lubricants, critical for manufacturing and transportation, saw an initial downturn as industrial activity stalled. However, by 2021, recovery was in full swing. Rising automotive sales, resumed construction projects, and a renewed focus on industrial efficiency pushed demand back on track. Saudi Arabia emerged as the region’s largest lubricant market, benefiting from infrastructure expansion and localization efforts under Vision 2030.

Automotive Lubricants: A Sector Built on Endurance

Internal combustion engines (ICE) still dominate the Middle Eastern automotive landscape. While electric vehicles gain traction globally, the region remains committed to traditional fuels for the foreseeable future. Saudi Arabia, Iran, and the UAE continue to register strong automotive sales. In Iran, car manufacturing grew 19% in 2022, surpassing 1.064 million vehicles, ranking the country sixth in global production growth. For the lubricants sector, this translates into sustained demand for high-mileage engine oils, transmission fluids, and performance-grade grease.

Industry leaders such as Toyota (30% market share in Saudi Arabia), Hyundai/KIA (26%), and Renault-Nissan-Mitsubishi (9%) dominate regional sales, reinforcing steady lubricant consumption. Multi-grade oils like 15W50 and 20W50 remain the preferred choice for commercial and aviation engines, underlining the continued reliance on viscosity-specific formulations.

Also Read: Why Middle East Lubricants Are Key to Saudi GDP Growth

Power and Heavy Industry: A Market Fueled by Energy

Saudi Arabia’s ambitious energy investments present a compelling case for sustained lubricant demand. The kingdom plans to inject USD 293 billion into power and renewables by 2030, including USD 38 billion earmarked for energy distribution infrastructure. This expansion necessitates specialized lubricants for turbines, transmission networks, and power-generating machinery.

Meanwhile, the country’s steel industry continues to expand. In 2023, crude steel production reached 9.9 million metric tons, an increase of 0.8% year over year. The government’s USD 12 billion investment in steel projects aims to increase total production by an additional 6.2 million tons, fueling industrial lubricant consumption.

Also Read: High-Performance Lubricants Reshaping Middle East Industries

Sustainability vs. Cost: The Evolving Market Challenge

Lubricant manufacturers are at a crossroads. On one hand, bio-based and synthetic lubricants present a sustainable future with enhanced efficiency. On the other, cost barriers hinder widespread adoption. Many businesses still prioritize affordability over environmental benefits, opting for mineral-based lubricants rather than premium alternatives.

However, innovation continues. Companies such as TotalEnergies, Petromin, Aljomaih and Shell Lubricating Oil Company (JOSLOC), Behran Oil Co., and FUCHS are leading the charge. These key players recognize the delicate balance between market trends and affordability, introducing tailored formulations to meet growing industry demands.

Looking Ahead: The Next Chapter for Middle East Lubricants

The Middle East Lubricants Market is poised for sustained growth. As the automotive sector stabilizes, power infrastructure expands, and industrial investment deepens, lubricant consumption will remain integral to operational efficiency. The challenge lies in balancing cost, performance, and sustainability, ensuring innovation without pricing out key industries.

Also Read: Eco-Friendly Lubricants Drive 6% CAGR Growth in the Middle East