The market of industrial lubricants Middle East is expanding even as EV adoption accelerates. Regional industrial lubricants alone are set to rise from about 4.52 billion USD in 2025 to 6.89 billion USD by 2033, marking solid growth. Broader Middle East lubricants revenues are also climbing, moving from 9.5 billion USD in 2024 to nearly 12.9 billion USD by 2033. Globally, lubricants are forecast to grow at around 2.9% a year.

What’s shifting is where the value is going. EV fluids are rising fast, jumping from 1.24 billion USD in 2025 to nearly 11.9 billion USD by 2034. With EV-fluid demand growing at about 18% a year, the market is moving toward advanced synthetics, dedicated EV coolants, and bio-based options.

EV Paradox: How EVs Drive Demand in Industrial Lubricants Middle East

EVs do not eliminate the need for lubricants. They transform it. Modern electric vehicles need up to 30% more thermal-management components than combustion cars. Batteries, power electronics, and fast-charging systems create intense heat loads, forcing OEMs to rely on specialized coolants and dielectric fluids.

This market is already significant. Next-generation EV cooling fluids are valued at around 1.2 billion USD in 2025, with rapid growth ahead as vehicles gain power density and fast-charging becomes standard. EV-specific fluids protect high-voltage components, prevent corrosion in cooling circuits, and stabilize temperature under extreme demand—tasks that even the best traditional lubricants cannot perform.

This is why the EV-fluids segment is growing six times faster than conventional oils. For the Middle East, where heat is a major engineering challenge, high-performance synthetics for hybrids and EVs are set to become core demand drivers.

Sustainability Push: The Rise of Bio-Based Lubricants

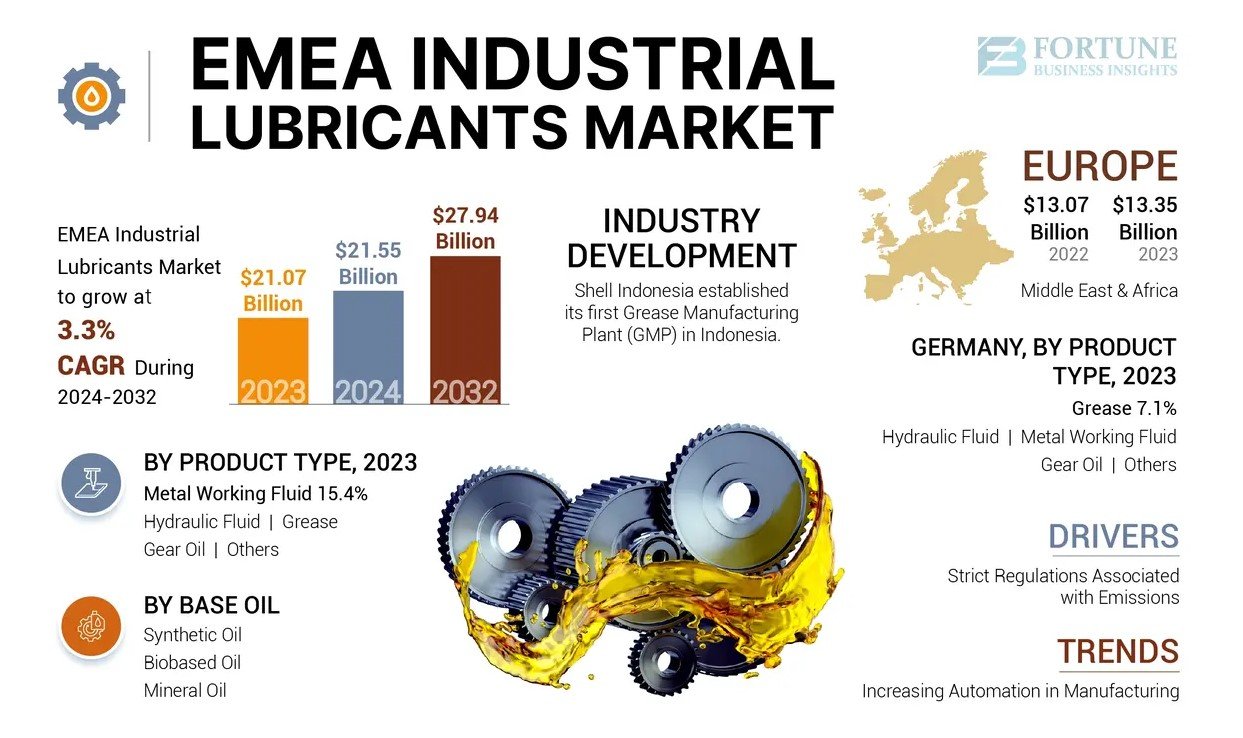

The global biolubricants market is expanding from 3.44 billion USD in 2024 to around 4.9 billion USD by 2032. Construction and off-highway equipment are leading the shift. Hydraulic fluids used in cranes, loaders, and tractors increasingly need to be biodegradable and low-toxicity to meet environmental standards and avoid soil and water contamination.

Bio-based lubricants made from renewable stocks help companies meet ESG targets while protecting sensitive areas. With environmental requirements tightening, these products are no longer niche—they are becoming mandatory in many heavy-duty operations.

The Competitive Frontline in Industrial Lubricants Middle East

The region’s market—expected to reach 3.31 billion litres by 2030—is shaped by both global majors and strong regional players. Giants like Shell, TotalEnergies, FUCHS, ExxonMobil, and Chevron compete with fast-advancing regional blenders such as Luberef, ADNOC Distribution, Petromin, and QALCO.

Saudi Arabia alone accounts for 37-38% of all regional lubricant consumption thanks to petrochemicals, transport, and mega-projects. Local-content programs in Saudi Arabia and the UAE, which require up to 70% domestic procurement, are giving regional blenders an advantage by encouraging in-country production and synthetic-oil innovation. This is sharpening competition across EV fluids, hybrid synthetics, and bio-based oils.

Where the Shift in Industrial Lubricants Middle East Leads Next

The industrial lubricants market in the Middle East is not shrinking. It is evolving. EV growth is pushing demand toward specialized coolants and high-performance synthetics. Construction sustainability goals are accelerating the rise of bio-lubricants. And competitive pressure is increasing as local blenders challenge multinationals in new high-tech categories.

To navigate these shifts, companies can benefit from expert guidance. The Middle East Lubricants by Eurogroup Consulting, with 40 years of distinguished experience, provides deep market research and strategic support across the region. For organizations aiming to understand and win in the industrial lubricants Middle East sector, its team offers the insights needed to succeed in this fast-changing landscape.